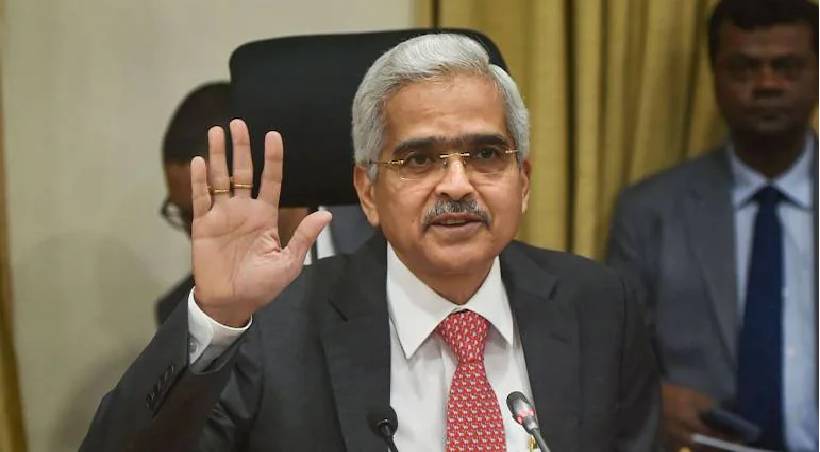

Reserve Bank of India (RBI) Governor Shaktikanta Das on May 5 announced that small finance banks were being permitted to regard fresh loans to microfinance institutions (MFIs), with asset size up to Rs 500 crore, for on-lending to individual borrowers as priority sector lending, amid the ongoing COVID-19 pandemic.

At present, lending by small finance banks (SFBs) to microfinance institutions for on-lending is not reckoned for priority sector lending (PSL) classification.

In view of the fresh challenges brought on by the pandemic and to address the emergent liquidity position of smaller MFIs, SFBs are now being permitted to reckon fresh lending to smaller MFIs – with asset size of up to Rs 500 crore – for on-lending to individual borrowers as priority sector lending. Mr Das added that this facility will be available up to March 31, 2022.

The central bank governor also announced a Rs 50,000-crore on-tap liquidity facility to ramp up health infrastructure and additional loan restructuring schemes amid a series of measures to help the financial services industry tide over the second coronavirus wave that threatens economic recovery.

RBI was monitoring the emerging developments related to the second wave of COVID-19 and its impact on the economy. The global economic outlook is highly uncertain and clouded with downside risks, according to RBI Governor. A forecast of a normal monsoon by the India Meteorological Department is likely to help sustain rural demand and have a soothing impact on inflation pressures.

In 2020, the impact of the nationwide lockdown was not seen on banks’ earnings because of the emergency measures announced by the central bank and the government. The RBI had announced a six-month moratorium and a subsequent one-time restructuring facility for banks. This had helped banks to escape a huge spike in their non-performing assets (NPAs).

Post Your Comments