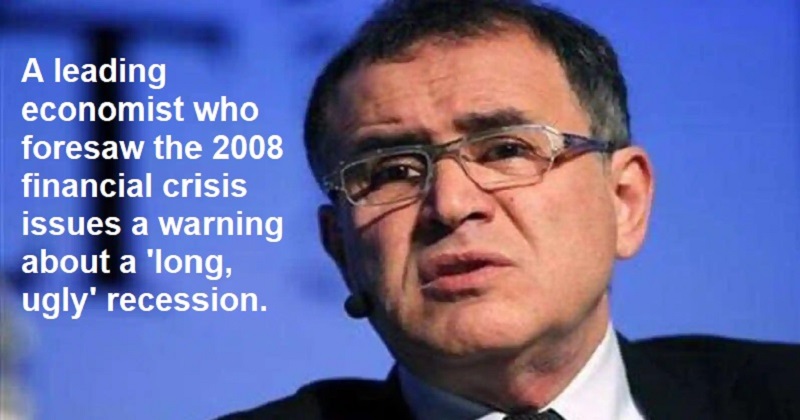

A ‘long and ugly’ global recession that might begin at the end of this year and last well into 2022 has been predicted by economist Nouriel Roubini, who is well recognised for correctly predicting the financial crisis the world experienced in 2008. He also anticipated a significant drop in the S&P 500. His warning comes in the wake of the Cocid-19 outbreak and Russia’s invasion of Ukraine, along with high inflation rates in the US and all other major economies.

The S&P 500 can decline by 30% even in a standard recession, ‘in a recent interview with Bloomberg, said Roubini, chairman and chief executive officer of Roubini Macro Associates. an extremely difficult landing,’ said Roubini, the US stock market index might decline by as much as 40%.

For correctly predicting the economic crisis between 2007 and 2008, Roubini, often known as Dr. Doom, stated that ‘Anyone predicting a temporary US recession should be watching the massive government and corporate debt loads.’ ‘Many zombie institutions, zombie households, zombie corporations, banks, shadow banks, and zombie countries are going to die,’ he said.

In addition, Roubini claimed that the Federal Reserve would find it ‘difficult’ to meet the US goal of 2% inflation without a harsh landing. Days before the Fed meeting, he had projected a 75 basis point rate increase in October and 50 basis points increases in November and December. This would imply that at the end of the year, the Fed funds rate will be anywhere between 4% and 4.25 percent.

He did offer investors some advise. Less stock holdings and more cash are required. Inflation causes cash to lose value, however unlike other assets like stocks, which may decrease in value by 10%, 20%, or 30%, cash’s nominal value never changes.

Post Your Comments