The fatal ‘Black Day’ in India November 8th, 2016, caused panic among citizens of India. The withdrawal of the higher denominations has the people taking up new financial trends.

In a recent survey conducted by FIS, a global leader in financial services technology reported that the average value of ATM withdrawals doubled, while the frequency of withdrawals declined when Modi government issued demonetization.

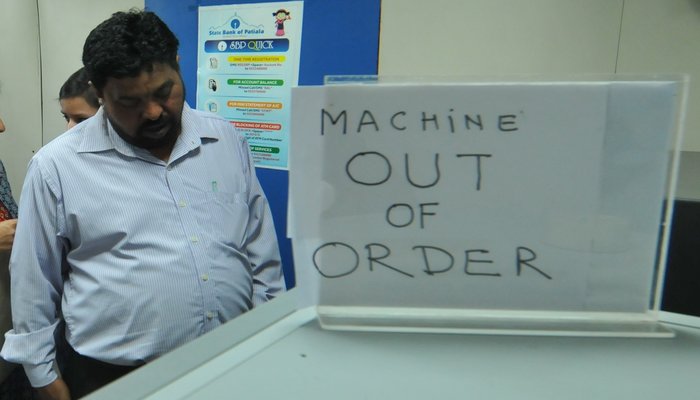

The survey on ATM usage by consumers in India found that while cash has remained the predominant mode of payment for household payments, other digital options have picked up momentum. The survey also highlights that in the months following demonetization, cash availability at ATMs was a key concern and long queues at ATMs resulted in lower customer satisfaction.

In terms of choosing an ATM to use, the study found that consumers prefer using ATMs run by their own bank. Location, proximity, and availability of cash are also important factors for Indian consumers while choosing an ATM.

The survey was conducted in India between May and June 2017. The sample size of 723 was distributed among online (500 respondents) and in person survey (223 respondents). The key criteria for the survey to commence were the respondent should perform cash withdrawals at least twice a month using their ATM/ Debit card.

“As disruptor fintech firms fill emerging needs in the financial services space, one of the differentiators that banks have is the ATMs are installed in every nook and corner of the country,” says Radha Rama Dorai, managing director for ATM and allied services, FIS India, adding that “rather than competing with digital disruptors, banks should change the rules of the game and enable multiple services on the ATM and make them more efficient. It’s time to reposition the ATM as a full-fledged service outlet as compared to the cash dispenser status that it is today.”

Currently, ATMs are the primary channel for just a few services. Clearly, there is scope to shift other services from bank branches to multi-function ATMs, including cash deposits, depositing cheques, updating passbooks, ordering cheque books, making utility payments, funds transfer etc.

“Banks should also ensure that ATMs are well stocked with the preferred denomination notes and banks should consider installing cash recyclers. This would address customers’ concerns about availability while reducing bank staff workloads and operational costs,” Dorai says.

Post Your Comments