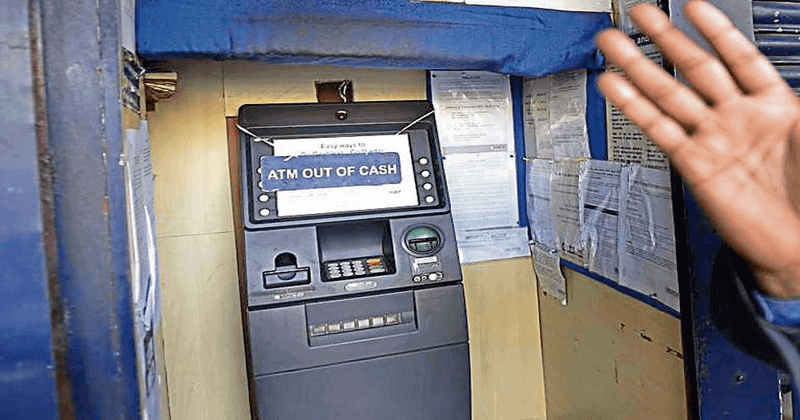

When you are out of ready cash you turn to your trusted friend – the ATM. But what if the ATM itself is out of cash?

Assam, Andhra Pradesh, Telangana, Karnataka, Maharashtra, Rajasthan, Uttar Pradesh and Madhya Pradesh—these are the states where are the cash shortage has affected the most.

People in Delhi have also been tweeting about non-availability of cash at ATMs. In south Delhi’s RK Puram and Khanpur, many ATMs have run dry say residents.

In Hyderabad, office goers have told a leading news agency that they have been unable to withdraw cash from ATMs in several parts of the city since yesterday. There are reports from Varanasi as well of people saying there is no cash at ATMs since yesterday.

READ ALSO: Security guard arrested for stealing ATM cash in Dubai

Here is what the people have commented, according to ANI:

Telangana: People in Hyderabad say, ‘We have been unable to withdraw cash from ATMs as the kiosks (ATM Kiosk), in several parts of the city, have run out of cash. We have visited several ATMs since yesterday but it is the situation everywhere’. pic.twitter.com/wRMS3jgjyP

— ANI (@ANI) April 17, 2018

People in Varanasi say, ‘We do not know what or where the problem is but the common man is facing difficulty as the ATM Kiosks are not dispensing cash. We have visited 5-6 ATMs since morning. We need to pay for the admission of children and purchase groceries & vegetables’. pic.twitter.com/8eSGXU0NtU

— ANI UP (@ANINewsUP) April 17, 2018

#MadhyaPradesh: People in Bhopal say ‘We are facing a cash crunch. ATMs are not dispensing cash. The situation has been the same since 15 days. We have visited several ATMs today as well, to no avail.’ pic.twitter.com/VwtR3s7flL

— ANI (@ANI) April 17, 2018

READ ALSO: This is the reason why there will be no cash in ATMs

Since the amount of currency put out by the Reserve Bank of India (RBI) and government printing presses is adequate for normal transactions, bankers believe there is hoarding of the Rs 2,000 notes. Nearly Rs 5 lakh crore worth of Rs 2,000 notes were printed after demonetization.

According to RBI data, currency in circulation as on April 6 was Rs 18.17 lakh crore, which is close to the number at the time of demonetization. While the growth in currency has been almost flat (compared to the day before demonetization), the need for currency has shrunk considerably because of the high level of digitization.

When the cash shortfall was reported from Andhra Pradesh and Telangana in March, it was attributed by some to a misunderstanding of the Financial Resolution and Deposit Insurance Bill, which had a ‘bail in’ clause where depositors would bear a portion of any losses. This purportedly triggered withdrawals from banks.

Bankers point out that currency in circulation typically peaks just before an election. But the only state going for elections in the coming weeks is Karnataka, which goes to poll on May 12. More cash is supposed to be in play as campaigning warms up further.

The demand for currency is also reflected in the slowdown in deposit growth. During the year ended March 2018, bank deposits grew by a measly 6.7% compared to 15.3% in 2016-17. During the same period, bank credit grew 10.3% compared to 8.2% in the comparable period in the previous year.

Post Your Comments