Happiest Minds Technologies registered a massive opening on the stock exchange, increasing about 138 percent on an intraday basis on its debut on September 17. The stock opened at Rs 351 on the BSE, which was also its intraday low, against the issue price of Rs 166.

Happiest Minds has a strong presence in the digital IT services sector. Its growing customer base of high revenue-generating clients, high proportion of repeat revenues and revenues from mature markets makes it strong candidate for a portfolio stock. Happiest Minds generated 97 percent of its revenues from digital IT services in FY20. It caters to multiple business segments like Edutech, Hitech, BFSI and Travel, Media & Entertainment.

It had 148 clients as on June 2020 and its high revenue-generating customer count increased 1.6x to 25 during FY18-FY20, with a high proportion of repeat revenues and revenues from mature markets. Manali Bhatia, Head of Research at Rudra Shares & Stock Brokers feels Happiest Minds is a portfolio stock. She is of the view that investors should hold the stock for long term.

“The company has scaled up in terms of revenue and profits and has a sound growth of about 50 percent. If it grows at a similar rate in future, forwarded valuations could be tremendous as per PEG ratio and the stock could be a multibagger in the long-term. We expect it could emerge out to be one of the disruptive companies in the IT industry,” she explained.

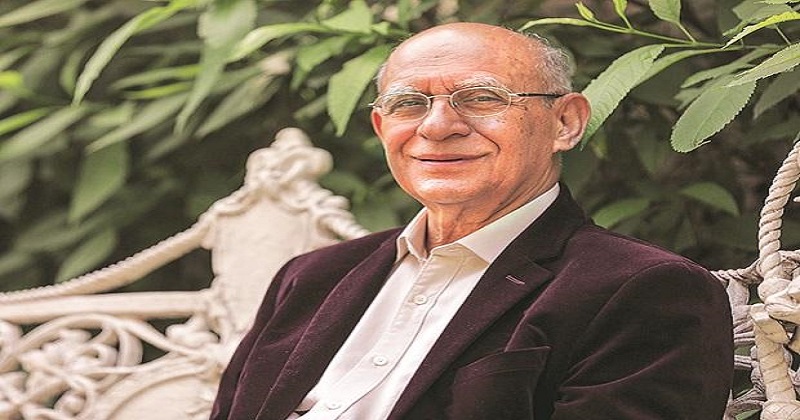

Ashok Soota is the promoter of the company. Before Happiest Minds, Soota was the founding chairman and MD of Mindtree and was also the vice-chairman of Wipro Ltd. “Happiest IPO might give an impressive return in mid to lon- term. Investors should hold stock at least for a few months, even if bought on the listing day,” Gaurav Garg, Head of Research at CapitalVia Global Research said.

“Happiest Minds can generate double-digit growth rate in the next five years. The founder and management seem to be experienced and that is what instils a lot of confidence in the company,” he explained. HCL Technologies, the third-largest IT company in India, provided its mid-quarter update. It expects revenue and operating margin for the current quarter (September 2020) to be meaningfully better than the top end of the guidance the company had provided in July 2020.

Post Your Comments