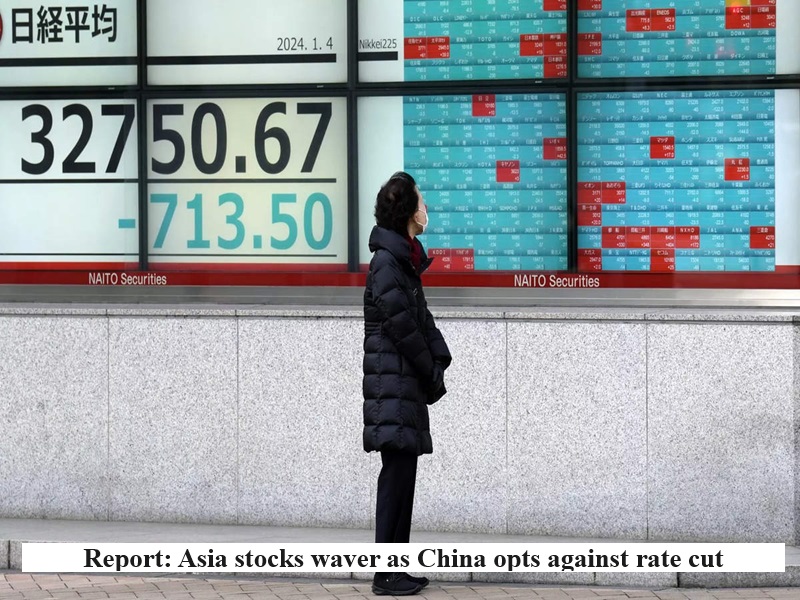

Monday brought an uncertain start for Asian shares as China’s central bank surprised markets by abstaining from a rate cut, leaving investors on edge ahead of crucial economic data. With China set to report fourth-quarter economic growth figures and monthly data this week, apprehension looms over the fragile state of its economic recovery.

Chinese blue chips dipped 0.5 per cent, hitting their lowest since early 2019. “For now, we think China is still focused on engineering economic stability,” commented Damien Boey, Chief Macro Strategist at Barrenjoey in Sydney.

While Asian shares faced headwinds, Japan’s Nikkei bucked the trend, rising 0.6 per cent to a fresh 34-year peak after stellar gains last week. However, MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.2 per cent, following a 0.8 per cent loss the previous week.

Geopolitical tensions, highlighted by the victory of Taiwan’s ruling Democratic Progressive Party, served as a reminder that global elections and Middle East conflicts could impact markets throughout the year.

The thin trading due to a US holiday added to the cautious mood, with progress on a stopgap spending bill providing a glimmer of stability.

Amid global uncertainties, the focus shifted to central bank actions. Futures pointed to a 75 per cent chance that the US Federal Reserve would lower interest rates as early as March. Barclays analysts adjusted their expectations for the first Fed cut from June to March, citing core personal consumption price index data running at or below 0.2 per cent m/m.

The dovish outlook prompted speculation that Fed Governor Christopher Waller could pave the way for easing in a speech on Tuesday.

As the World Economic Forum unfolded in Davos, European Central Bank speakers, including President Christine Lagarde, took center stage. ECB Chief Economist Philip Lane suggested there would be enough data by June to decide on the first of a potential series of interest rate cuts.

Markets, fully priced for easing in April, implied a substantial 154 basis points of cuts over 2024. This dovish sentiment, coupled with global economic concerns, has limited the euro’s gains against the dollar, which idled at $1.0950 on Monday.

In the currency markets, the dollar held its ground against the yen, supported by subdued Japanese data keeping the Bank of Japan committed to its accommodative policies. The dollar edged up to 145.08 yen, moving closer to last week’s peak of 146.41.

Meanwhile, non-yielding gold stood firm at $2,050 an ounce, backed by the prospect of lower global interest rates. Oil prices experienced some volatility due to disruptions in the Red Sea but faced pressure from demand concerns. Brent eased to $78.10 a barrel, while US crude fell to $72.45 per barrel.

Post Your Comments