The fuel prices have recently skyrocketed the past few days, burning a hole in the consumers’ pockets. The Center has been facing backlash over the topic.

Yesterday, Prime Minister Narendra Modi had headed the Union Cabinet meeting held to discuss the fuel price rise.

To tame the rising fuel prices, the government on Thursday said it was working on a long-term plan to tackle volatility and frequent revisions of fuel rates.

Earlier in the day, industry leaders reiterated the demand for a change in the tax structure in order to bring down petrol and diesel prices. Addressing the media after a Cabinet meeting on Wednesday, law and information technology minister Ravi Shankar Prasad said, “Instead of an ad-hoc measure, the government wants to have a long-term view that addresses not only volatility but also takes care of the unnecessary ambiguity arising out of frequent ups and downs,” Prasad said.

Among the proposals being discussed is that OMCs, too, should be asked to take a small hit by way of compensating petrol and diesel dealers a cut in their commission. Such a cut would be passed on to consumers along with an excise duty reduction. This would be a three-way burden sharing — government, OMCs and consumers. Prasad said excise duty or other taxes collected on fuel are “very clearly used for the country’s development, for construction of more national highways, more roads, more digital infrastructure, and taking power to those villages which were without it for so many years.”

Hindustan Petroleum Corporation (HPCL) chairman and managing director M K Surana, however, said the country needed a review of the taxation to bring down the retail price of fuel.

READ ALSO: Big B and Akshay Kumar called ‘deaf and dumb’ after silence on fuel price hike

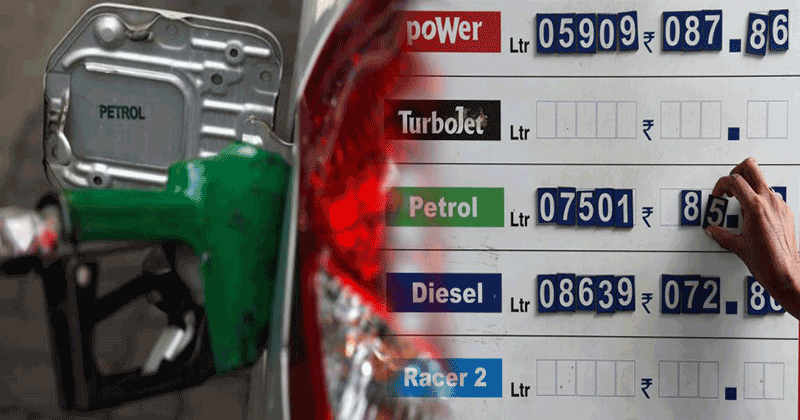

Petrol and diesel prices touched new highs of Rs 77.17 a litre and Rs 68.34, respectively, in Delhi on Wednesday. On the other hand, Mumbai prices were the country’s highest – Rs 84.99 for petrol and Rs 72.76 for diesel. When asked about the rising prices, Surana said, “There is a need to review the taxation structure. The long-term solution before the country is to bring all petroleum products under the GST.”

The prices of Brent crude was seen at $79.19 a barrel at one point on Wednesday, while the Indian basket crude oil prices was seen at $78.10 a barrel. He added there was no immediate global trigger that would bring down international prices in the near future. “We will be happy to have it around $60-70 a barrel range. We are able to partly take care of the sudden spike in international markets as we take a 15-day average to determine Indian prices,” he added.

On Tuesday, BJP president Amit Shah hinted at a possible change in the formula of determining the pricing of petroleum products. Petroleum minister Dharmendra Pradhan was at a meeting of oil marketing companies but officials said it did not take up the issue of price rise. When asked about whether benchmarking to international prices need a re-look, Surana said, “Earlier, we were following a cost plus model. In my opinion, benchmarking brings efficiency. After it replaced the earlier cost plus model, there has been a lot of improvement in things like energy efficiency and gross refining margins of companies.”

According to industry sources, every $1 increase in crude price demands an increase of around 63 paise a litre in the prices of both diesel and petrol.

Centre can cut petrol price up to Rs 25 but will not do so: Chidambaram

Amid rising criticism over steep hike in fuel prices, senior Congress leader P Chidambaram on Wednesday claimed it was possible to cut up to Rs 25 per litre in petrol prices but the government will not do so

Post Your Comments