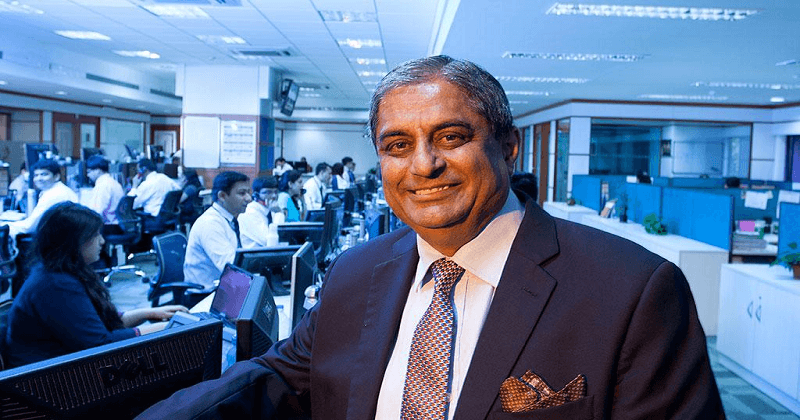

HDFC Bank CEO Aditya Puri, who has been the highest-paid Indian banker for years, has seen a small dip in overall remuneration to Rs 9.6 crore in FY18 from Rs 10 crore in FY17 despite the bank’s net profit rising 20 per cent to Rs 17,487 crore.

The compensation could change if the central bank approves a higher performance bonus. According to information in the bank’s annual report, bonus for FY17 has not been paid out as it is pending RBI approval and therefore not disclosed. In FY17, he had received a performance bonus of Rs 92 lakh.

The ratio of Puri’s salary to that the median is 209:1. However, his salary has not increased in line with the 8.9 per cent average percentage increase for key managerial personnel and non-managerial staff. Puri holds around 0.13 per cent stake in the bank, which is worth about Rs 687 crore. Puri, who has led the bank for 24 years, is credited with creating the country’s most valuable financial institution, which is today worth nearly Rs 5.3 lakh crore.

Uday Kotak, founder and CEO of Kotak Bank, received compensation of Rs 2.92 crore in FY 18 (Rs 2.63 crore last year), which is 48.44 times the median salary in the bank. However, despite the relatively modest salary, Kotak ranks 104 in the Bloomberg Billionaire Index with assets worth nearly Rs 76,000 crore because of his 29.75 per cent holding in the bank.

Read More: Abu Dhabi government announced the list of public holidays for 2018

Yes Bank CEO Rana Kapoor’s total remuneration for FY18 stood at Rs 5.35 crore compared to Rs 6.81 crore in FY17. This was despite the bank’s net profit rising nearly 27 per cent to Rs 4,224 crore in FY18. His salary is 79 times the median salary in the bank. Kapoor’s individual shareholding in the bank is worth Rs 3,306 crore.

Shikha Sharma, MD & CEO of Axis Bank, has seen her salary dip marginally to Rs 2.90 crore from Rs 2.94 crore in the previous year. This does not include other perks such as HRA, deferred variable pay and company contribution to provident fund. Her remuneration is 77.6 times the median.

ICICI Bank is yet to publish its annual report for FY18. The bank’s CEO Chanda Kochhar received total remuneration of 5.54 crore in FY17 which was 112 times the median. As compared to the private sector, public sector bank chiefs receive modest salaries. For instance, the chairman of SBI, the country’s largest bank, received compensation of Rs 14.25 lakh for the second-half of FY18 after he took charge mid-year. However, analysts point out that public sector banks have a higher wage to income ratio because of higher entry-level salaries and also because private sector banks score higher in terms of productivity.

Post Your Comments