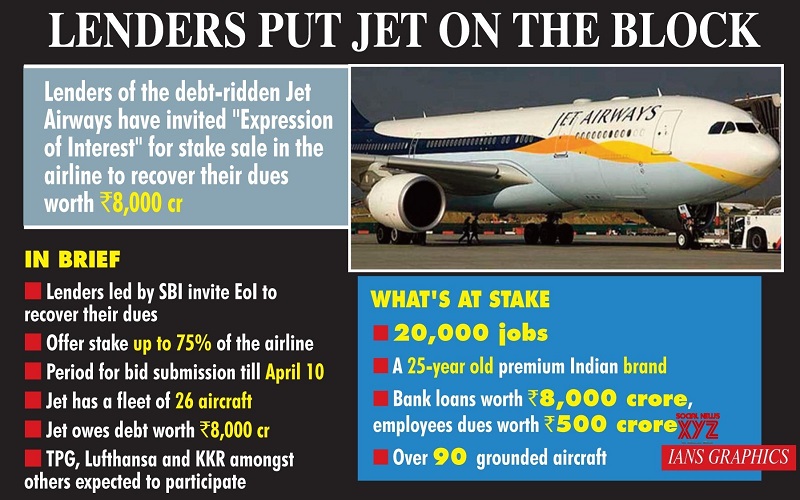

The debt-ridden Jet Airways will sell its 75% shares to raise capital. The lenders of Jet Airways has invited bids from overseas and Indian investors for up to 75% of the carrier. The bids have been sought from both strategic and financial investors. Resident and non-resident Indians, foreign individuals and persons of Indian origin living abroad can also bid.

The expression of interest (EOI) bids will have to be submitted by April 10 along with a stack of documents that must include a solvency certificate to qualify for the right to stump up a bid. The binding financial bids will have to be submitted by April 30.

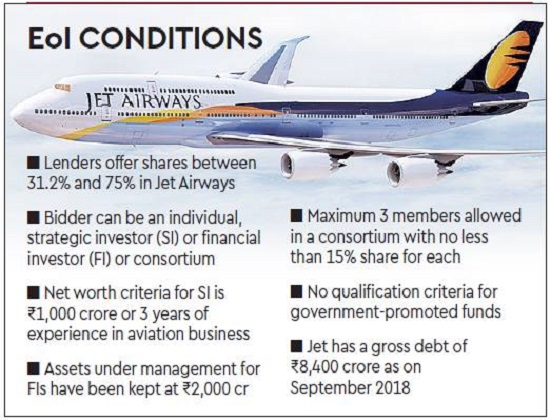

In a public notice, the SBI invited expressions of interest (EoI) “for the change in control and management” of Jet Airways. More importantly, the EoI document showed that the potential bidder will have to acquire at least 3.54 crore shares, or 31.2% of the equity of the company, and a maximum of 8.52 crore shares or 75% equity.

Tough financial criteria have been set for the qualifying bidders but the lenders have cut some slack for public sector units, government agencies and sovereign wealth funds which have been given the right to go straight into the bidding round.

Any individual, trusts, co-operative societies, private and public companies, sole proprietary firms or partnership firms can bid. So can companies registered outside India.

The likely bidders include Tata Vistara, Delta Air, Etihad and investment firms like TPG and NIIF.

Under the plan worked out in February this year, the lenders had agreed to convert just one rupee of Jet’s debt of Rs 8,000 crore into 11.4 crore shares — at a time when the stock closed at Rs 264.10 a share on the BSE on Monday.

Post Your Comments