India has had deep-rooted links with Sri Lanka, once Ceylon. After the ethnic war broke out between the Sinhalese and the minority Tamils on the island state, India extended relief owing to two factors, initially it was driven by its domestic affairs of Tamil Separatists triggering their drive; secondly, it needed to limit other large powers from abusing the power void. After Rajiv Gandhi’s assassination by the LTTE suicide bomber in 1991, India was compelled to hold a hands-off policy, it wasn’t solely in India’s concerns to stay apart from the civil war. Meantime, China was increasing its relations with Sri Lanka while it initiated up defense company NORINCO in Sri Lanka to give arms to the Sri Lankan Army.

By the closing steps of the war, while India was imposed on moral and political terrains to stop the supply of rude weapons, the Chinese gladly gave Sri Lankans the sought weaponry and supported in the international discussions over human rights violations and war atrocities. Mahinda Rajapaksha, the then President had an evident reason to lean towards China, which more supported him back his post in the nation. The massive economic values that Sri Lanka caught during the civil war drove Rajpaksha to locate International partners to promote Sri Lanka’s most important economic assets, its harbors.

While Rajapaksa had a choice of extending its present ports – Colombo and Trincomalee, he decided to produce an economically destructive port to reinforce his support in his home constituency by increasing Hambantota Port. China’s Belt and Road Initiative (BRI) has been extremely scrutinized for its implementation and price of returns on numerous events, and one could never disconnect the strategically positioned Hambantota International Port from the BRI. This port was given over to China Merchants Port Holdings (CMPort) on a 99-year contract by the Sri Lankan government with a sum of US 1.12 billion as the island country couldn’t give back the funding capital deficit to China.

Political activists and commentators saw this deal between the China Merchant Port Holdings Company (CMPort) and Sri Lanka Ports Authority (SLPA) as an illegal agreement. Remarkably, the Chinese state-owned company CMPort now has an overall pale of 80 percent, and the SLPA has 20 percent. This is one of the chief causes why Sri Lanka is quoted as a prey of the debt-trap tact of China’s BRI. But presently, while the world remains to fight the pandemic, the fortunes of the Hambantota port appear to be shifting.

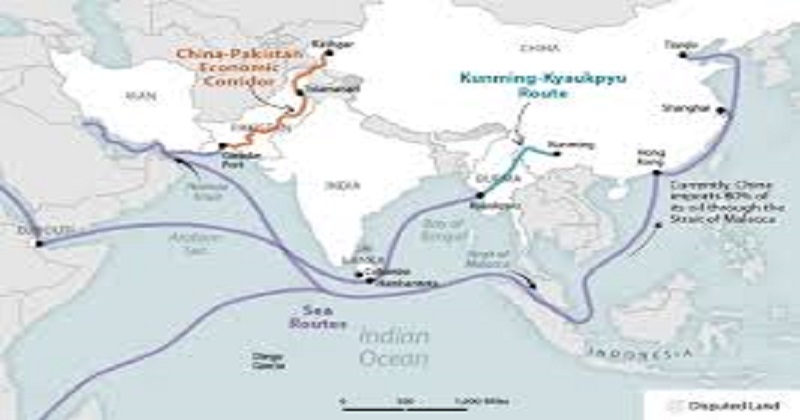

Hambantota is adjacent to the Asian and European international shipping ways the Suez Canal and the Strait of Malacca. These courses through Hambantota are practiced by about 36,000 ships, including 4,500 oil tankers. The port keeps about three days of sailing time and fuel. China will surely set in all its strength to make up for the lost time in generating the Hambantota International Port as one of the most famous ports in the country and keep nations like India on its toes.

History

In 2015 and 2016, the Central Bank of Sri Lanka said that Hambantota was the only harbor with an adverse increase rate and that it had a declining number of vessel arrivals. The Asia Maritime Transparency Initiative remarked that “the economic rationale for Hambantota is weak, given existing capacity and expansion plans at Colombo Port, fueling concerns that it could become a Chinese naval facility,” a recognition that at the time-restricted other moneylenders such as India from becoming intricate.The vows of extended trade and economic wealth were defeated almost quickly as the port unlocked its gates in a shambolic inauguration ceremony, but the plan fell Sri Lanka into a spiraling deficit to China. In 2017, the Sri Lankan government had limited option but to return over 80 percent of the port’s control to CMPort on a 99 year-long lease, along with 1,235 acres of land.

In 2018, critics aimed out the total abandonment of the harbor with wildlife roaming open on its mainly left bases. When the port was under the Sri Lankan regime, it was hardly operational due to the scarcity of operational properties and inadequate knowledge to begin up and operate a harbor of that range. Later, the port required an operational partner with a wide property to satisfy its requirements. The CMPort invested in approximately 1.12billion to renew the port under a public-private partnership. The CMPort had to spend at least 700800 million dollars or more to make the port to the operational level at its complete capacity.

One year later Hambantota International Port (HIP) came under its current management, the port centered on roll-on/roll-off (ro-ro) operations and increased its business, with a 136 percent rise in the volume of ro-ro ships managed by the operational team. The HIP has since expanded its services to incorporate other port-related exercises such as container Handling, General Cargo, Passenger, Bunkering, Bulk Terminal, and Gas at the initial stages. The geographic positioning of HIP provides benefits not only for the shipping industry but also for import/export business in common, linked with an experienced approach to ship or transship complete goods to nearly any destination in the area, as the port can offer relatively shorter timelines with just six to 10 nautical miles (19km) to the world’s most active maritime route between the Malacca Straits and the Suez Canal linking Asia and Europe.

Accelerated increase in economic development in developing markets surrounding the Indian Ocean, such as the Bay of Bengal and East Africa, has produced growth opportunities for Sri Lanka’s port industry, in addition to more settled maritime business with India. The deep-water terminal facility of Hambantota can berth the most comprehensive of ships with comfort and efficiency. Gains in Hambantota involve competing for labor charges, freeport facilities, ample area for storage, dry weather throughout the year. This provides HIP its competitive side to expand as a competitive regional maritime and logistics hub. Given the shift of the maritime industry in the upcoming decades concerning 2020 low sulfur cap laws, Hambantota is an ideal place to invest in storage tanks, refineries, and liquified natural gas (LNG) bunkering facilities with a higher ability to promote the global ship fleet.

Bunkering is the providing of fuel for use by ships and holds the shipboard logistics of filling fuel and spreading it with available bunker tanks. Another sign of their resurgence is their intent to hit into the market of fuel stations in both Singapore and Fujairah, two of the biggest fuel depots in the world that supply over 60 million tonnes of fuel per year. The port is appearing as an RO-RO transshipment hub. RoRo explains how products are filled and removed from a vessel. RoRo enables your products to roll on and off the vessel, as resisted being raised onboard using cranes. Self-propelled products such as cars and tractors roll on and off the vessel on their wheels. The port entered its 1 million metric tonnes yearly benchmark in 2019 with volumes from 3 sectors i.e. RO-RO, Bulk, and Liquid cargo.

HIP said it had engaged in an aggressive marketing campaign and changed the RO-RO business model, which had brought results. The Sri Lankan Cabinet of Ministers has approved the proposal presented by the Minister of Industries to set up a ‘Smart One-Stop Shop’ comprising the representatives of all relevant institutions to enable local and foreign investors interested in investing in industrial zones associated with Hambantota Port and Industries in the Southern Province. Measures have been taken to establish several industrial zones in the Southern Province in connection with the recent infrastructure development. The Board of Investment (BOI) of Sri Lanka has signed the agreement with Pearl Energy (Pvt) Ltd to launch ‘Hambantota LNG Hub’ a floating storage LNG trading facility at the port of Hambantota, bringing LNG to the doorstep of Sri Lanka, with a primary aim of trading LNG in the region utilizing the strategic location of Hambantota.

Read more; Government employees were punished with a pay cut for leaving work 2 minutes early!!!

The HIP has made a vital connection with Sinopec Fuels of Lanka (SOFL) which aims to extend Sri Lanka’s part of the regional bunker market and has spent over 5 million in a tanker that flies the Sri Lankan flag. Operations have now begun with local bunker supplier Lanka Marine Services (LMS) as SOFL’s first buyer providing very low sulfur fuel oil (VLSFO) to the tanker Suez Hans enroute from Chennai to Suez. The tanker refueled at the Hambantota Port anchorage through oil barge Kumana, engaged to LMS by the HIP. Not to forget, the concerns encompassing the East Container Terminal (ECT) including India, Japan, and Sri Lanka have shaken the stability of the Indian Ocean more. The project, meriting an estimated $500-$700 million, was a key mark for infrastructure financing in the island country where Chinese projects are most famous. More than two-thirds of transshipment at this harbor is attached to India, making it an important business and connectivity link.

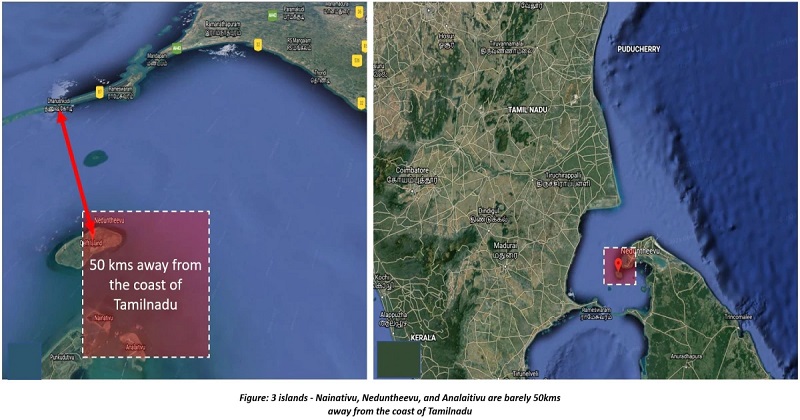

Finally, it is also an appropriate warning for the Quad (a group of India, the US, Australia, and Japan) and other nations that China must not be signed off yet. The HIP has been reinvigorated within two years. Moreover, Sri Lanka has also removed an energy project including China across three islands off the shore of the Jaffna peninsula mere 50km from the Tamil Nadu coast. The project is to introduce “hybrid renewable energy systems” in the three islands of Nainativu, Neduntheevu, and Analaitivu. With Hambantota International Port meeting better possibilities, one can only assume the growing potential of the same. India and Quad will presently have to reset their viewpoint on the HIP, an asset that was regarded as inert mass only a couple of years ago.

Post Your Comments